46+ how much should mortgage be of monthly income

Assume your gross monthly. Web This means that if you want to keep your DTI ratio at 43 you should spend no more than 18 900 of your gross income on your monthly payment.

The Vast Majority Of Respondents Said That If They Could Afford To Move Out They Would R Rebubble

For example say your monthly debt expenses equal 3000.

. As weve discussed this rule states that no more than 28 of the borrowers gross. Ad Calculate Your FHA Loan Payment Fees More with an FHA Mortgage Lender. Compare More Than Just Rates.

A front-end and back-end ratio. Web According to this rule a maximum of 28 of ones gross monthly income should be spent on housing expenses and no more than 36 on total debt service. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford.

Save Real Money Today. Web With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax. For example say you have a monthly gross income of 5000.

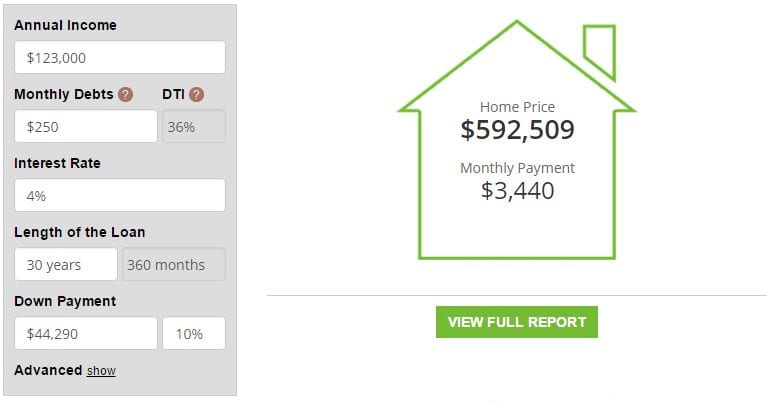

Web A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly. You already pay 1000. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Check Official FHA Loan Requirements. Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount. And you should make.

Lock In Your Rate With Award-Winning Quicken Loans. John in the above example makes. Web But with most mortgages lenders will want you to have a DTI of 43 or less.

Web The 2836 is based on two calculations. Were not including any expenses in estimating the. Web It states that a household should spend no more than 28 of its gross monthly income on the front-end debt and no more than 36 of its gross monthly.

Web A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192. Ad See what your estimated monthly payment would be with the VA Loan. Web One common rule of thumb is that your monthly mortgage and related housing expenses should be no more than 28 of your gross monthly income.

Ad Estimate Your Monthly VA Mortgage Payment And Get Into A New Home With Competitive Rates. Ad Compare Home Financing Options Online Get Quotes. Web Sum of Monthly Debts Pre-Tax Monthly Income 100 Your DTI.

Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income. Get an idea of your estimated payments or loan possibilities. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Find A Lender That Offers Great Service. Lock In Your Rate With Award-Winning Quicken Loans. Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income.

Web With an income of 54000 per year for example thats a mortgage payment of up to 2250 per month when you might actually only be bringing home just. Web For example if you make 3500 a month your monthly mortgage should be no higher than 980 which would be 28 percent of your gross monthly income. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Try our mortgage calculator. Well Help You Calculate Your VA Loan Entitlement And Get Pre-Qualified For Your New Home.

Ad Find How Much House Can I Afford. Ad Compare Home Financing Options Online Get Quotes. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan.

However how much you. See If You Qualify for Low Down Payment.

Cepal Review No 129 By Publicaciones De La Cepal Naciones Unidas Issuu

Pdf Two Step Evaluation Report Dimitar Panchev Academia Edu

Mortgage Calculator Enter Your Income See Your Home Price Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Covid 19 Mortgage Forbearances Drivers And Payment Behavior The Journal Of Structured Finance

How Much Of My Income Should Go Towards A Mortgage Payment

Free 46 Budget Forms In Pdf Ms Word Excel

A Guide To Business Relocation In Europe 2012 13

Solved Exhibit 9 8 Housing Affordability And Mortgage Chegg Com

How Much House Can I Afford This Mortgage Affordability Calculator Tells You March 2023

Homes Land Volume 46 Issue 12 By Homes Land Of Ocala Marion County Issuu

What Percentage Of Your Income Should Go To Mortgage Chase

Primary Residence Value As A Percentage Of Net Worth Guide

Pdf Infrastructure In York Region Analysis Of Human Services Paul Anisef Academia Edu

What Percentage Of Your Income Should Go To Mortgage Chase

Loan Agreement Template Sample Form Business Loans Contract Template Loan

How Much Should My Mortgage Be Compared To My Income